In 2017, a 2-bedroom apartment in Toronto could be found for $1500/month. Today, the same apartment rents for $2450/month—a development that's impoverishing families and pushing many out of major cities or into the streets. Several factors are driving rent sky-high in Ontario—and one major cog in this machinery of rent inflation is Above Guideline Increases (AGIs).

While the provincial cap for rent increases in Ontario was set at 2.5% for 2023, landlords can also apply to the Landlord-Tenant Board (LTB) for an additional AGI. An AGI is an increase above the provincial rent cap that can be approved if:

- There has been an increase in local property taxes;

- The landlord has made capital expenditures (significant renovations, repairs, replacements or new additions the expected benefit of which extends for at least five years); or

- The landlord has experienced a rise in operating costs related to security services with respect to the residential complex.

While AGIs are justified by landlords as a mechanism to recuperate funds spent on building improvements, the process often consists of disruptive and less-than-necessary renovations to lobbies, elevators, windows and balconies. Invariably, these cosmetic renovations (which attract new tenants) play out while landlords generally neglect other essential building maintenance and overdue repairs inside tenants' units.

To make matters worse, the LTB can authorize an AGI application for up to 3 consecutive years. Assuming a 1.8% guideline increase, for example, plus a 3% AGI approved for 3 years, this is the equivalent of rent increasing by 14.4% after 3 years. But landlords are only required to inform tenants about their rent increase for a given year, thereby concealing the full increase of rent in the years to come.

AGIs, in tandem with the provincially-set annual guideline increases, give landlords a mechanism to squeeze longer-term leaseholders out of their units entirely. Then, once a unit becomes vacant, the unit can then be rented out as high as "the market" will allow, thereby incentivizing landlords to pursue AGIs to effectively evict long-term tenants in exchange for higher-paying new tenants.

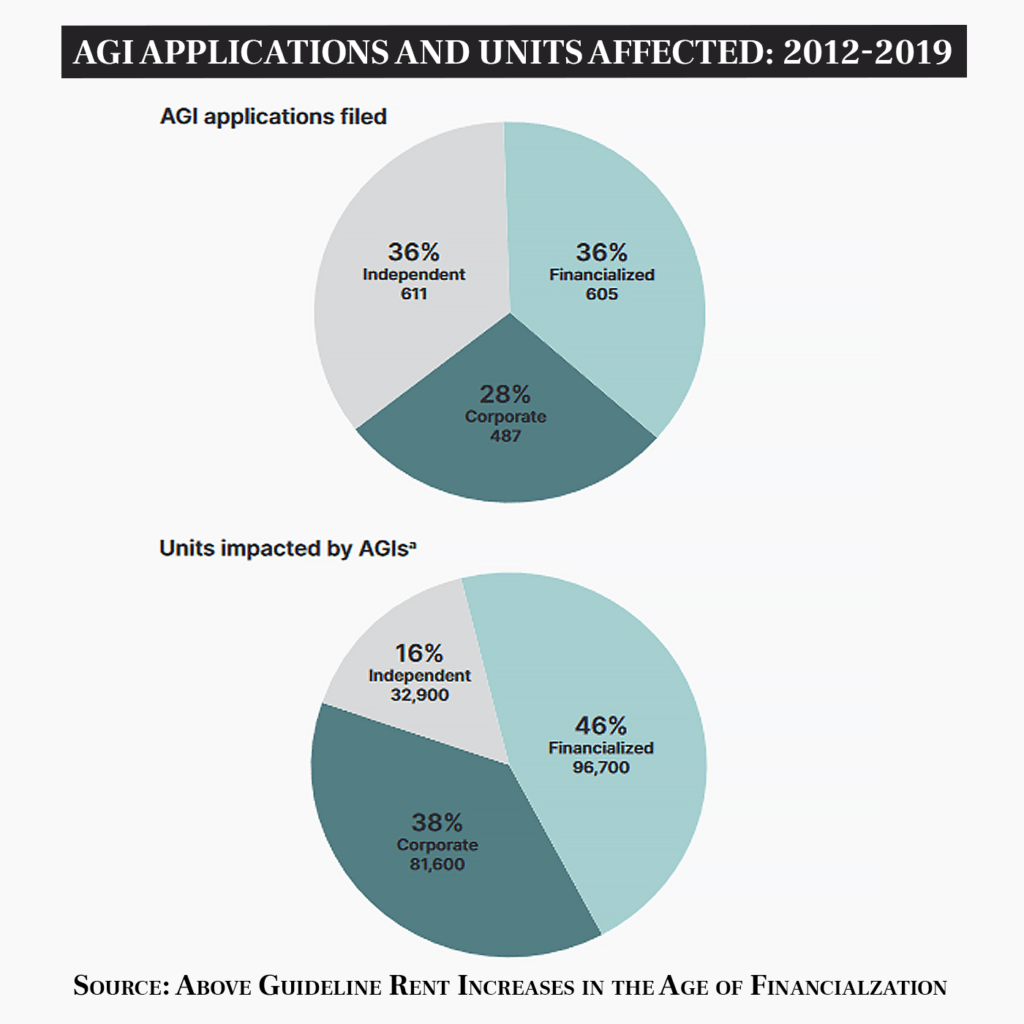

AGIs can be disputed via the LTB, but it is a grueling process for tenants that, in the best of cases, results in a negligible reduction to AGIs—never their removal. The most notorious seekers of AGIs are financial firms that acquire properties and units as incoming-generating products for investors. Together, these firms make up 64% of all AGI applications in Toronto from 2012-2019, impacting 178,300 units.